Towns at Skyland Purchaser Qualifications:

Habitat for Humanity of Washington, D.C. and Northern Virginia creates affordable homes in partnership with qualified buyers who are in need of housing.

Below is an overview of the Purchaser Qualifications:

Purchasers must meet all of the following:

- First-time homebuyer (having not owned real estate in the last 3 years)

- Minimum household size of 3

- No household member on the sex offender registry

- Primary residency or at least one applicant with full-time employment in DC, Alexandria, Falls Church, Fairfax, Fairfax County, or Arlington County for the last 12 months or more

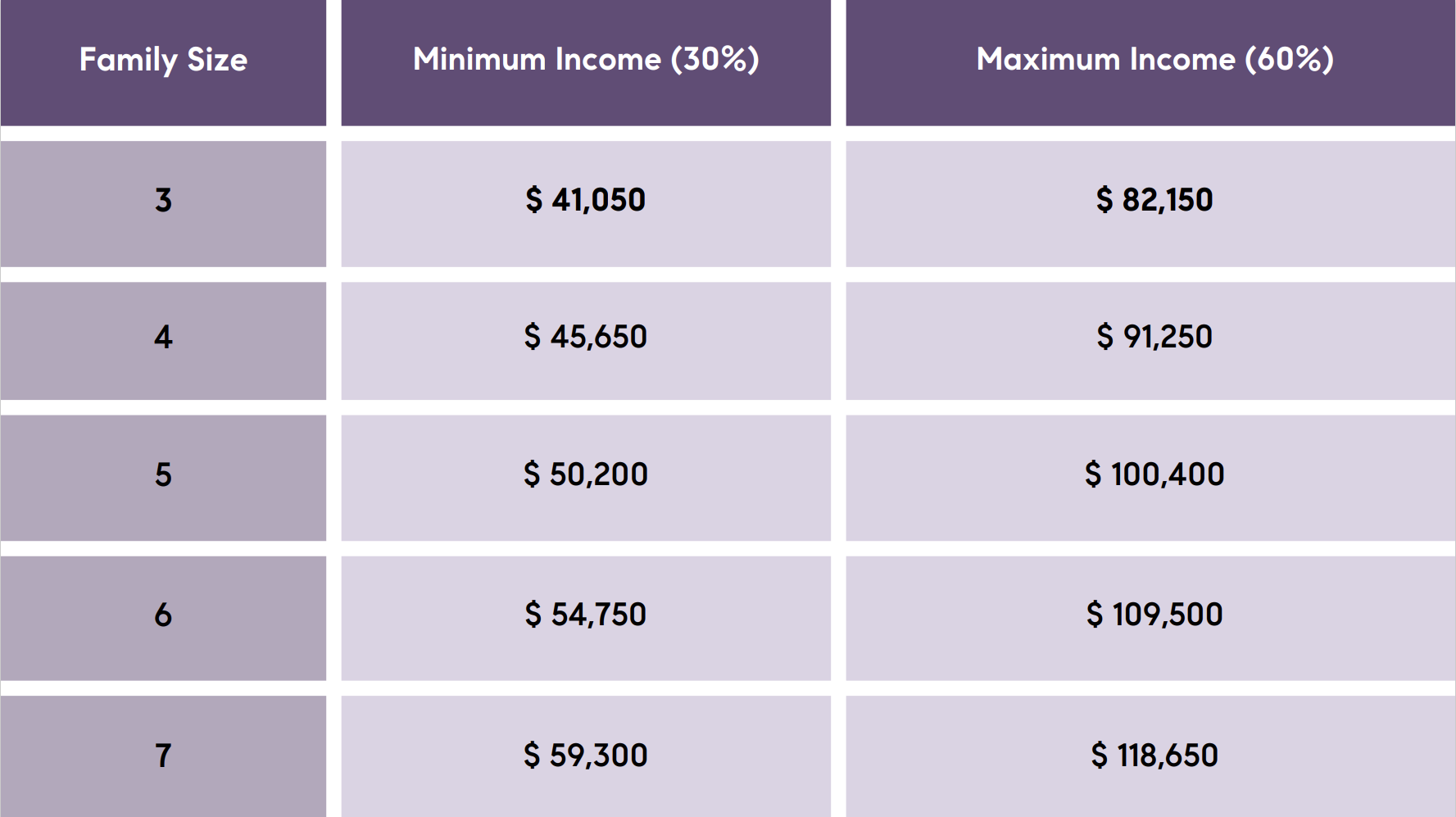

- Total household income falls between 30-60% of Median Family Income (MFI) as defined annually by the U.S. Department of Housing and Urban Development (shown above). The 2022 MFI was $142,300.

And meet at least one of the following need-based requirements:

- Unsafe surrounding environment

- Residing in temporary housing

- Living in subsidized housing or participating in a housing voucher program

- Overcrowding

- Rent burden (paying more than 30% of monthly income on rent)

- Heating, electrical, plumbing, or structural deficiencies

Ability to Pay

Purchasers must meet all of the following:

• If wages or salary are primary sources of income, a 2-year work history that includes a minimum of 6 months with the current employer and any gaps in employment must be explained; | • Current credit reports must not show bankruptcy in the last 3 years or foreclosures in the last 7 years; |

• Tri-Merge middle credit score of 620+; | |

• If self-employed, must have 2 years of documented, stable income with the last 6 months in the same line of work; | • Qualify for non-subprime or approved alternative third-party financing; |

• Income can reasonably be expected to continue for 3 years or more; | • Total Debt to income ratio, including new housing cost must be less than 43% of your monthly income |

• Current credit reports free of unpaid collections, judgments, and liens; | • Show at least $500 in current bank statements, no account overdrafts in the last two months, and bank statements or proof of assets not to exceed 10% of the fair market value. |

Willingness to Partner

Douglass CLT and Habitat want to ensure that people who are normally priced out of homeownership have an opportunity to build some equity while keeping the home affordable for the next buyer. When (and if!) Skyland homeowners sell their house, the new price will be calculated so that they gain financially, but the home is still affordable to someone at a similar income level.

All program participants must complete 300 hours of "sweat equity," or volunteer work. This may include working on the construction site, attending homeownership and financial literacy classes, and/or volunteering in the office or at special events.