Where Will The Housing Market Go From Here?

There’s one big question on every prospective buyer and seller’s mind right now. Where’s the market headed for the rest of the year?

There’s no denying this has been a tumultuous year for our country. But unlike the last time we saw an economic downturn, real estate is set up to help us out of it, not into it.

However, the current imbalance between buyer demand and low inventory puts the market in a peculiar place. Without more homes coming to market, real estate can’t play its role in the economy.

The biggest piece that’s holding sellers back is the unknown. Without an idea of what’s ahead, people will continue to sit on their hands until they feel safe.

Economic Recovery

What role will housing play?

The National Bureau of Economic Research officially announced that we’re in a recession, but that doesn’t mean what most people think.

According to the NBER, a recession is a significant decline in economic activity spread across the economy, normally visible in production, employment, and other indicators.

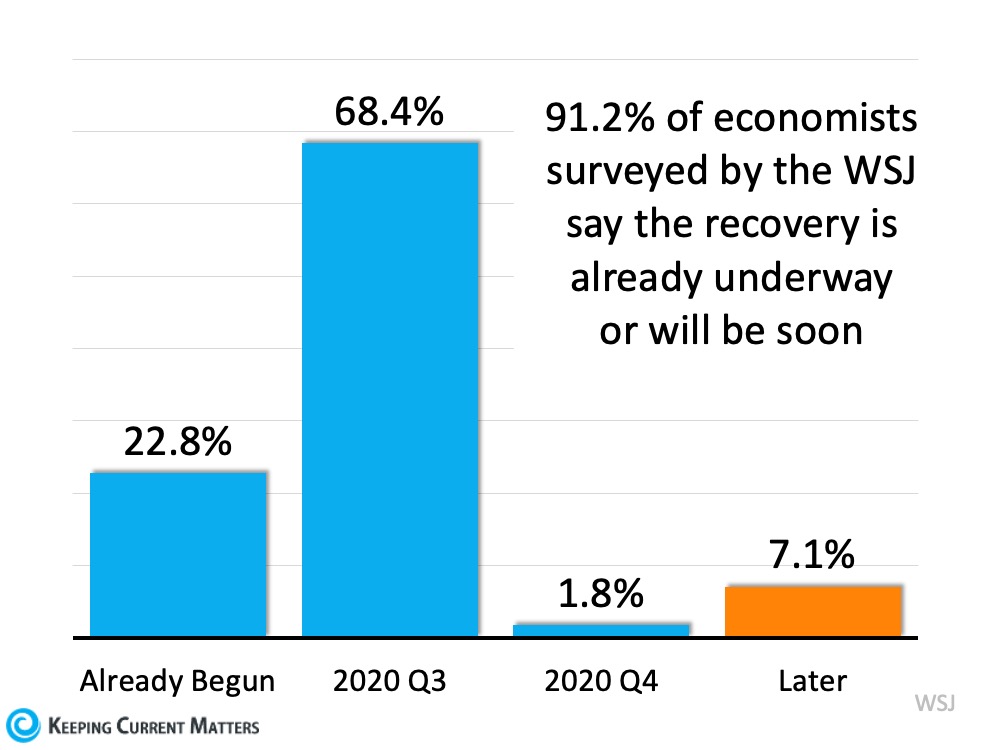

The pandemic’s effects on businesses across the country have understandably led to slowed economic activity, but we’re already seeing signs projections of a recovery in the second half.

Moreover, a recent Wall Street Journal report found that more than 9 out of 10 economists surveyed believe the recovery has already begun this quarter or will begin in the third quarter of this year.

But the fear that’s holding many potential buyers and sellers back from moving forward with their initial plans is very real: they also think a housing crash will follow.

Mark Fleming, chief economist at First American, explained, “Many still bear scars from the Great Recession and may expect the housing market to follow a similar trajectory in response to the coronavirus outbreak. But, there are distinct differences that indicate the housing market may follow a much different path.”

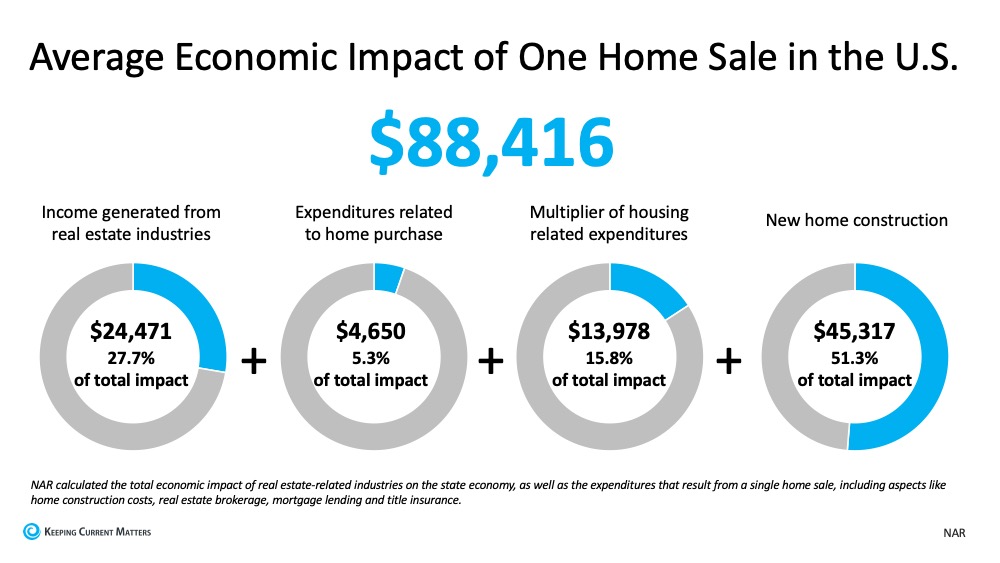

More experts have echoed Fleming’s thoughts on housing, stating that the real estate market will most likely play the opposite role of what it did for the Great Recession. This time, it will help stimulate the economy and bring us out of a decline faster.

The market conditions that led to the housing collapse– overbuilt stock and risky mortgages- are the exact opposite of what we’re seeing today. Low-inventory and stricter lending practices have set real estate up to remain strong, despite our country’s economic fragility.

High Buyer Demand

This year is seeing more interest than last.

While you’d assume that this year’s turbulence may have deterred buyers from making a move, we’re seeing that the pandemic hasn’t really slowed homebuyers at all.

The biggest motivating factor in this is historically low mortgage rates, which has greatly increased affordability.

According to Freddie Mac, “Purchase demand activity is up over twenty percent from a year ago, the highest since January 2009. Mortgage rates have hit another record low due to declining inflationary pressures, putting many homebuyers in the buying mood.”

This “buying mood” combined with low inventory is driving an increasingly competitive market with sellers in the driver’s seat. On top of that, growing equity is allowing many homeowners to sell for an increased profit, and then reinvest their earnings in a new home.

For first time buyers looking to own their first home, there has never been a more crucial time to be pre-approved and ready to act as soon as they find the home of their dreams.

Low Inventory

Why Seller confidence is key

While prospective buyers are returning to the market in masses, there’s still one piece of the equation that remains skeptical: sellers.

If inventory was low before the health crisis, it’s hit rock bottom. Understandably, many of those who were thinking of selling this year have put their plans on hold, with fear of the market’s future and the safety of their family top of mind.

But equity is growing. Home values are appreciating. And economists are forecasting that real estate will not only finish 2020 strong, but growing in strength.

“The housing recovery has been nothing short of remarkable. The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back,” said Ali Wolf, chief economist of Meyers Research.

For prospective sellers that have put their plans on hold, regaining confidence is key. At Love Live DC, here are the safety precautions we are taking for all showings to help keep both buyers, sellers, and agents safe.

Demand for housing will only grow as states continue phased reopening. This puts sellers in a strong position to get their house sold quickly and easily, with more equity in their pocket to put into a new home.

Waiting could mean more homes coming to the market, which also means more competition among other sellers in the neighborhood. The sooner sellers take action, the better position they’ll be in to make sure their home stands out to buyers.

Bottom Line

The real estate forecast for the rest of the year varies in projections, but supply and demand will always determine prices. If supply remains low and demand continues to be fueled by low-interest rates, prices will continue to rise as most experts project.

But some people are still reluctant to open up their minds and their homes to the thought of selling. Without this piece of the equation, the market can’t play its part in our economic recovery.

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.

.jpg?w=128&h=128)