Summer Housing Market Update in Washington DC

As the summer sun heats up, the housing market in Washington DC brings its own set of intriguing developments. Today, I’m sharing an update on the summer housing market, drawing from our most recent market report and home demand index reports. If you’re curious about the current trends and what they might mean for you, keep reading!

A Less Predictable Summer Market

The “summer” market is typically sandwiched between the more active spring and fall markets. Historically, this period has seen slower home sales, generally confined to July and August. However, this year, we observed an earlier onset of slower market conditions starting in early June.

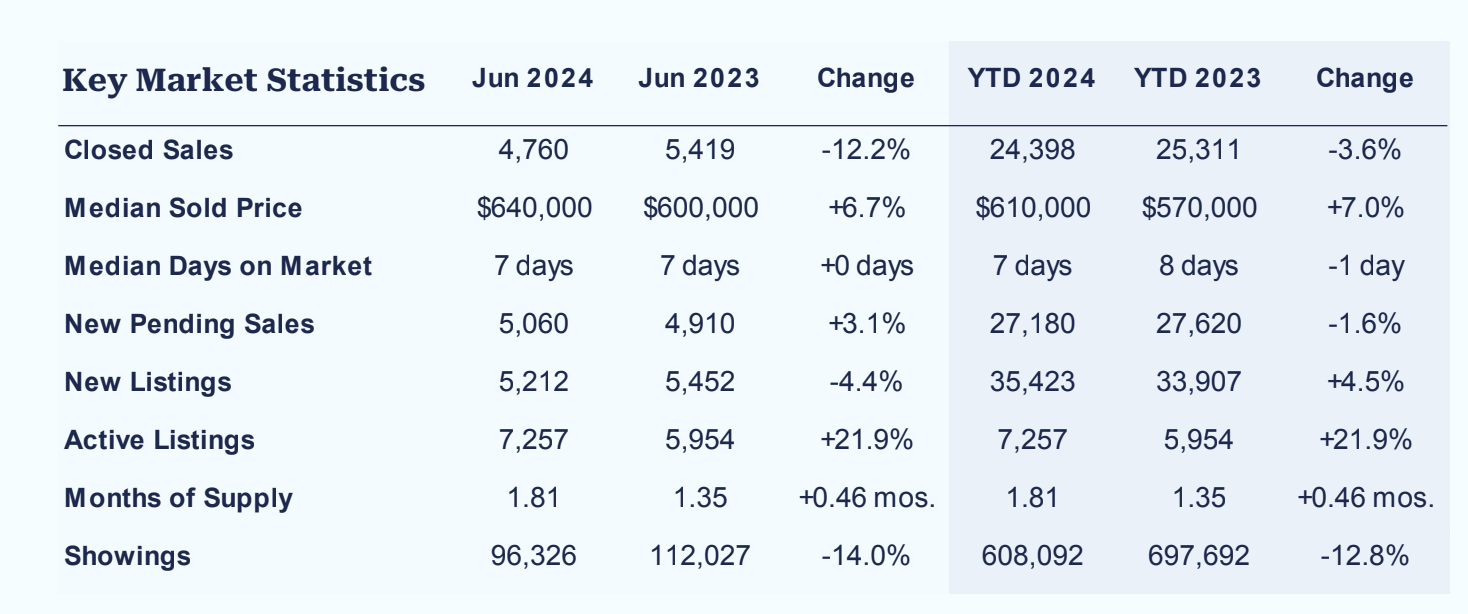

Key Market Statistics

Here’s a snapshot of what we’ve seen so far:

- June Sales: Down 12.2% year over year in the DC area.

- Active Listings: Up almost 22% year over year.

- Median Sales Price: Up 6.7% year over year.

These numbers reflect broader market trends, but it’s essential to dive deeper into the local specifics to understand the full picture.

Steady Interest Rates, Slower Sales

Throughout the second quarter of 2024, interest rates have remained relatively steady. The slower pace of sales isn’t due to a recent increase in rates but rather the prolonged presence of rates in the 7% range, which is likely playing a role in buyer hesitation.

Regional Variations

One of the most striking aspects of this summer’s market is the variation in local market activity. Different regions within DC have shown significant differences:

- Closed Sales: Down 24.2% year over year.

- Active Listings: Up 29.2% year over year.

- Median Prices: Up 17.9% year over year.

Supply and Demand Dynamics

Typically, we’d expect prices to decrease when sales decline, and inventory increases, but this hasn’t been the case. The key to understanding this anomaly lies in the diversity of DC’s submarkets. Each submarket has its own supply and demand factors, leading to varied performance.

Demand has greatly varied based on home type and location. For example:

- Rowhomes and Single-Family Homes Below $535,000: This segment has seen the lowest demand in the DC market.

- Single-Family Homes Above $1.28 Million: This segment has experienced the highest demand.

- 1 Bedroom Condos: Buyers in this segment have different considerations compared to those looking at detached single-family homes.

Looking Ahead to the Fall Market

Predicting the fall market is challenging, especially with the potential fluctuations in interest rates. If rates hold steady through the end of the year, we might not see significant changes in market conditions. However, any shifts in rates could quickly alter the landscape.

Stay Informed

For sellers, particularly those in slower markets, understanding what higher inventory means is crucial. Stay tuned for my next video, where I’ll dive deeper into this topic and provide valuable insights for navigating this market.

Want to stay updated on the latest market trends and what they mean for you? Visit our blog regularly and subscribe to our newsletter for timely updates and expert analysis.

Contact Us Today!

If you’re interested in buying or selling in the current market, don’t hesitate to contact us for personalized advice and strategies to achieve your real estate goals.

.jpg?w=128&h=128)